| Traditional IRA | Roth IRA |

| Take advantage of tax benefits today. | Enjoy tax-free withdrawals in the future. |

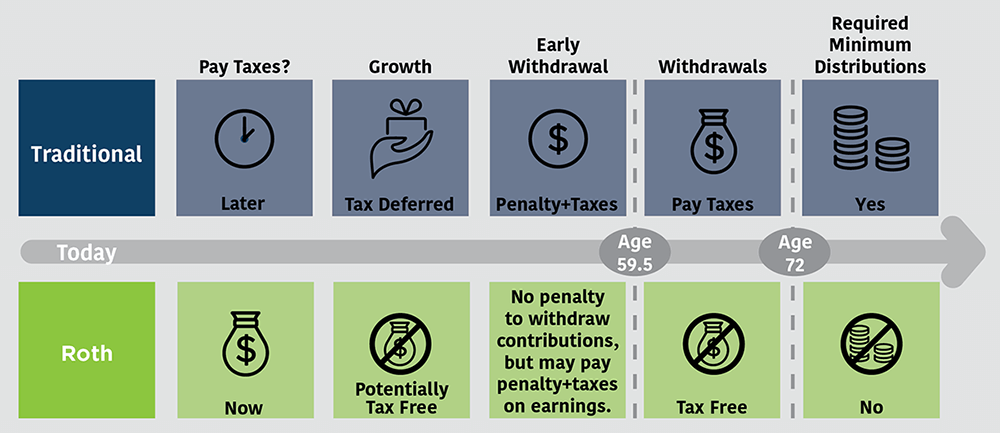

| You deduct contributions now and pay taxes on withdrawals later. | You pay taxes on contributions now and get tax-free withdrawals later. |

| Tax deduction in contribution year; ordinary income taxes owed on withdrawals. | No tax deductions for contributions; tax-free earnings and withdrawals in retirement. |

| Allow you to make pre-tax contributions. Contributions grow tax-deferred. | Allows you to make after-tax contributions. Contributions grow tax-free. |

| Mandatory distributions after age 72. | No mandatory distributions. |

| Contribution: $6,000; $7,000, if age 50 or older. | Contribution: $6,000; $7,000, if age 50 or older. |

| No income limits. | Eligible are single tax filers with MAGIs of less than $140,000 (phase-out begins at $125,000); married couples filing jointly with MAGIs of less than $208,000 (phase-out begins at $198,000). |

Tax

Traditional IRA contributions are tax-deductible on both state and federal tax returns for the year you make the contribution. As a result, withdrawals, officially known as distributions, are taxed at your income tax rate when you make them, presumably in retirement.

Contributions to traditional IRAs generally lower your taxable income in the contribution year. That lowers your adjusted gross income (AGI), possibly helping you qualify for other tax incentives you wouldn’t otherwise get, such as the child tax credit or the student loan interest deduction.

With Roth IRAs, you don’t get a tax deduction when you make a contribution, so they don’t lower your adjusted gross income that year. But, as a result, your withdrawals in retirement are generally tax-free. You paid the tax bill upfront, so to speak, so you don’t owe anything on the back end.

Distribution Rules

With traditional IRAs, you have to start taking required minimum distributions (RMDs)mandatory, taxable withdrawals of a percentage of your funds—at age 72, whether you need the money or not.

Roth IRAs carry no required minimum distributions: You’re not required to withdraw any money at any age or indeed, during your lifetime at all.2 This feature makes them ideal wealth-transfer vehicles. Beneficiaries of Roth IRAs don’t owe income tax on withdrawals, either, though they are required to take distributions or else roll the account into an IRA of their own.

Note

You can own and fund both a Roth and a traditional IRA (assuming you’re eligible for each); however, your total deposits in all accounts must not exceed the overall IRA contribution limit for that tax year.

Sources:

https://www.investopedia.com/retirement/roth-vs-traditional-ira-which-is-right-for-you/

https://www.schwab.com/ira/understand-iras/roth-vs-trad-ira

https://www.hillsbank.com/understanding-traditional-roth-iras